“Simply stated, Carson City roads are failing,” says a new city website dedicated to road issues.

That site, www.preservecarsoncityroads.com, was spearheaded by staff in the transportation division and public works department to raise awareness of ongoing road-funding issues at a time when voters are being asked to retain a 5 cent-per-gallon diesel tax that helps fund local roads.

“We want readers to come away informed as to how Carson City roads (arterials, collectors, and local streets) are collectively funded and maintained, and to be aware that current revenues are not keeping up with ongoing pavement deterioration,” said Transportation Manager Chris Martinovich.

The site breaks down current funding, projected shortfalls, and potential new funding sources. It also provides an update of pavement conditions and information on how roads are falling into disrepair.

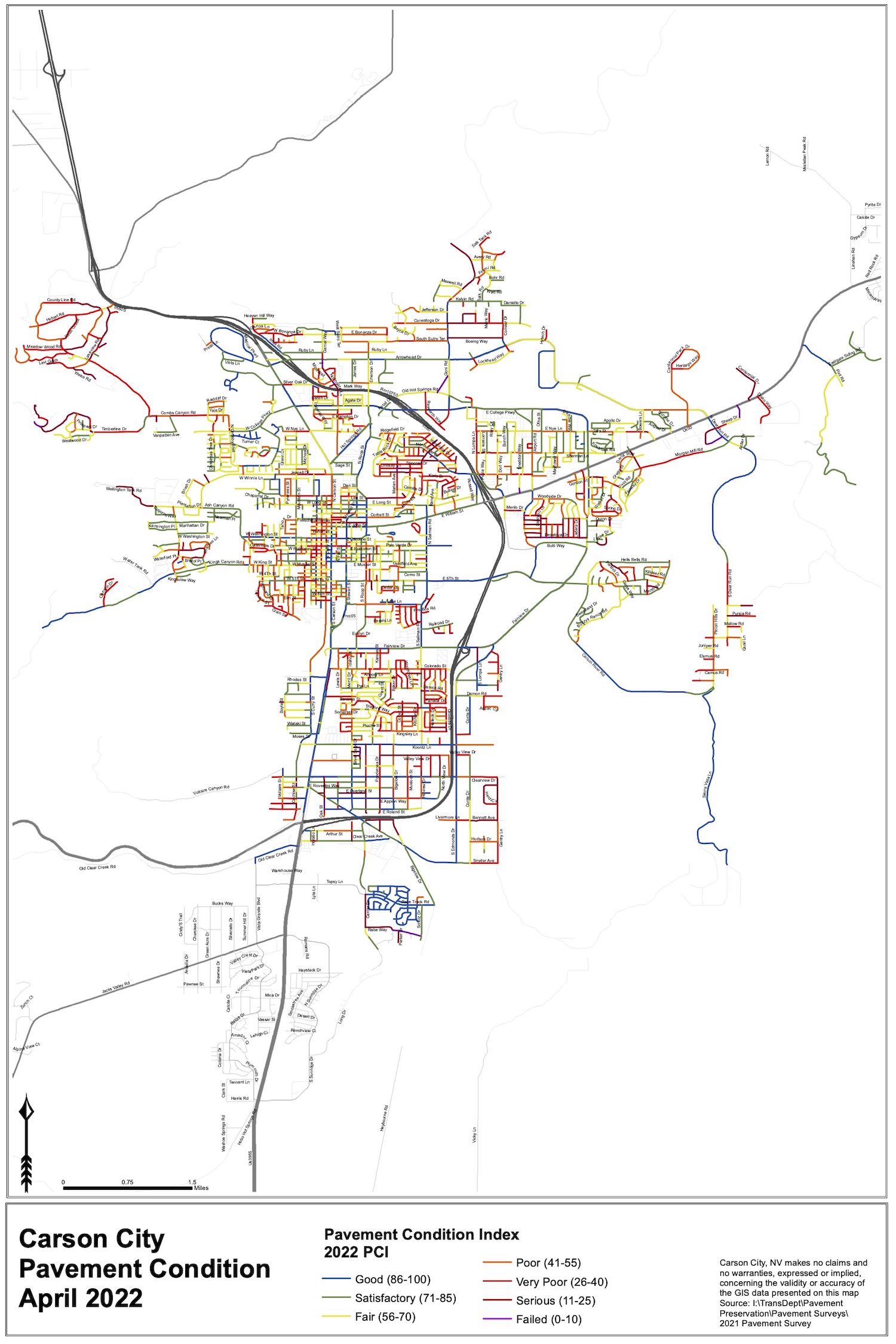

A map showing pavement conditions for Carson City streets.

A map showing pavement conditions for Carson City streets. According to the website, more than 60 percent of larger regional roads (collectors and arterials) are faring well, in good or satisfactory condition. These roads qualify for federal funding. Local neighborhood roads, which make up 71 percent of the city’s total roadways, are faring significantly worse. They do not qualify for federal funding. Less than 30 percent of local roads are in the good or satisfactory category. More than 45 percent are in poor condition or worse.

According to the new site, an estimated $21 million gap between revenue and current maintenance needs is “only expected to grow with decreased fuel demand and increased construction costs.” The current annual revenue for roads is about $4.5 million. That comes from the existing diesel tax, a 15.35 cent-per-gallon tax on gasoline, and from sales tax. The basic city/county relief sales tax makes up 35 percent of annual roadway funding, compared to 55 percent from fuel taxes.

“All of the BCCRT goes to the city’s Street Operations Division,” said Martinovich.

He said the division is responsible for sealing cracks, filling potholes, curb, gutter, and sidewalk replacement, street sweeping, snowplowing, traffic signal operations and repair, and other tasks.

Another 10 percent of current funding comes for waste management franchise fees and the V&T infrastructure sales tax. The latter is scheduled to sunset in 2027.

“The V&T infrastructure sales tax was authorized to pay for the purchase of bonds to finance the reconstruction of the V&T Railroad from Virginia City to the Eastgate Depot,” Martinovich said. “The majority of the sales tax goes toward debt payments associated with those bonds. The sales tax and plan of expenditure were amended by the Board of Supervisors in December 2018. The amended plan of expenditure includes expenditures for street and highway preservation and rehabilitation projects when the revenue generated by the sales tax is greater than that needed to make the debt payments toward the bonds.”

The existing 5 cent diesel tax – approved by supervisors in 2020 – raises about half a million dollars a year for Carson City roads. If not approved by voters, the tax will sunset at the end of this year.

“Due to the funding gap, the city has had to prioritize and direct the limited funding toward highly-traveled regional streets leaving neighborhood streets untouched,” says the new website. “Even with this strategy, only 1.7 percent (4.7 miles out of 284 miles) of city-owned roadways were preserved/rehabilitated in fiscal year 2021.”

The new site also lists future funding options. They include general improvement districts and local improvement programs – with special assessments on properties based on trip generation of land-use type – and more sales taxes: a one-eighth-cent tax to replace the V&T infrastructure tax when it sunsets and a quarter-cent transportation sales tax.

“The longer the city goes without additional funding for roadway infrastructure, the more expensive it will become,” warns the website.

In other words, preventive maintenance is cheaper than wholesale reconstruction.

“Regarding the future funding mechanisms, we are continuing to investigate each of the four shown on the website,” Martinovich said. “Presentations will be made to the RTC and the Board of Supervisors in the coming months regarding the pros and cons of each option. The goal is to narrow down the options further, but by how many and which options are unknown at this time without further research and input. It may take more than one option to best meet the needs of our deteriorating roadway infrastructure.”

Supervisor Maurice White said this election cycle, voters have a decision to make regarding the diesel tax.

“As the city is nowhere close to meeting the financial needs for asphalt maintenance, we either raise new revenue or decide whether asphalt is or is not more important than other programs and projects,” White said. “The residents of this community will need to inform the supervisors what direction they want to go.”

White said residents can get involved at the Regional Transportation Commission meetings, which are held the second Wednesday of every month in the community center. The meetings follow Carson Area Metropolitan Planning Organization meetings, which begin at 4:30 p.m.

Comments

Use the comment form below to begin a discussion about this content.

Sign in to comment